In a recent board meeting, an investor asked why the company was not burning adequate cash to grow more rapidly. I’ve been running profitable businesses for decades (startups included) and hearing the adage ‘cash is king’ since. But the concept of cash burn as a strategy puzzled me.

I decided to talk to a few young professionals, who are very enthusiastic about burning cash, to understand their reasoning. Even at 65, there are skills one can learn. I was keen to acquire this rather interesting skill of burning up cash when someone has invested in me. Here are my learnings on how to approach this beast called cash burn.

Cash burn is the rate at which a company uses up its capital to run its daily operations with or without contribution from revenue and margins. Simply put, volume influences business performance. Unit revenue minus unit cost called Gross Margin or in investor parlance ‘Unit Economics’ and fixed overheads. If the business sells adequate volume and the unit economics is positive, and the Gross Margin equals overheads, the cash burn stops.

Insufficient volume commensurate with the size of fixed overheads can cause a cash burn. Negative or very low unit margins or a combination of these are also causes. Let us analyse these elements to understand what can be a prudent way to use cash burn as a strategy. Let me illustrate this with an example:

- Market chosen is 10% of addressable market & the size of the market is 50 mn units

- This is an existing service and market addressed by the unorganized sector

- Fixed overheads is at US $ 20 mn a year

- Unit realisation is US $ 4 & Unit cost is US $ 3 and hence unit economics is US $ 1; The organisation needs to sell 20 mn units to stop cash burn

- At 20 mn units the market share will be 40% – is this possible?

The Profitability Table

| Units | 20/21 | 21/22 | 22/23 | 23/24 | 24/25 | |

| Market size | Mn | 5.0 | 5.5 | 6.0 | 6.5 | 7.0 |

| Sales | Mn | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 |

| Market share | % | 10 | 18 | 25 | 31 | 36 |

| Revenue / Unit | $ | 4 | 4 | 4 | 4 | 4 |

| Cost / Unit | $ | 3 | 3 | 3 | 3 | 3 |

| Unit Economics | $ | 1 | 1 | 1 | 1 | 1 |

| Gross Margin | $ Mn | 0.5 | 1.0 | 1.5 | 2.0 | 2.5 |

| Fixed costs | $ Mn | 2.0 | 2.2 | 2.4 | 2.5 | 2.5 |

| Cash burn! | $ Mn | (1.5) | (1.2) | (0.9) | (0.5) | Nil |

Quantum of money spent out of capital of the company

The company burns cash of $ 4.1 mn in five years after breaking even in the fifth year. Now let us analyze different situations based on investors strategy:

UNIT ECONOMICS LEVEL

‘Buy market share’ sooner. You can offer price discounts of $ 4 to lubricate the market on the belief that the company can get to 36% share in the third year instead of 5th year. This is the strategy followed by OYO, Swiggy, Jio and many others. In the case of Swiggy, every masala dosa you eat is partly funded by an investor. When Jio announced increase of 40% in tariff, the basic lesson is that no one can endlessly operate on negative margin.

Companies with financial muscle can afford this strategy. If the price drop is $ 1, the Gross Margin is zero leading to much larger cash burn and shareholders fund this as a strategy.

This is a correctable strategy to an extent – how far will the company be able to take back the price without affecting volume will still be in doubt. Or is the strategy to make money in selling other products.

Two things to keep in mind. One, the ability to raise prices to an acceptable level later. And two, continuous watch to see whether the discounting strategy is delivering market share or not.

The company needs to be able to achieve $ 3 as variable cost. If the cost model is not proven, it will lead to an additional cash burn. In this case, it is not a strategy but inability to execute a cost strategy or seek corresponding compensation in the market. If the targeted cost is not achieved or price rise is not feasible, unit economics will remain negative leading to perpetual cash burn. Constant watch on this critical.

If the unit economics continues to be negative and there is no demonstrated plan to make it healthy, the business will cease to exist. This fundamental held good fifty years ago and still holds good. The most important factor to be proven in any business model is unit level profitability.

FIXED COST VS VOLUME TRADE OFF

High aspiration of market share. In this model, the company is the only organised player which hopes to pull in 36% market share in year 5 and even considers advancing it. What if the volume aspiration is not met? Even with a positive unit economics, the company may not generate enough volumes to eliminate cash burn. Can the fixed costs be reduced to reflect this market reality?

$ 4.1 mn cash burn is only for the geographical territory accounting for 10% of the market. If an aggressive approach leads to 100% market coverage from day one, the cash burn will be $ 41 mn. What if the model fails or leads to lower profitability? Money lost can never be recovered.

- Is the value proposition to the customer solid? Why should the customer move from the unorganised sector?

- Are the fixed costs appropriately dimensioned? If not, the additional fixed costs will put extra burden to increase market share which is already planned to be at a high level. What is the appropriate fixed cost?

- Are profile of employees and hence the cost in line with the market size and complexity

- Do we need positions that exist in large organisations but may be superfluous in a startup? Is outsourcing such jobs better than having full time employees?

- Are company policies and hence costs appropriate to the business we are in.

I recollect the board of a small company, where the board members were all from very large organisations. They wanted to introduce a sophisticated ERP system where on a small piece of paper one could figure out everything in the environment. Timing is critical.

Another organisation engaged at an enormous cost a well-known cricketer as ‘brand ambassador’ for its product. Much to the delight of the board members, they found that the company’s products were being sold in less than 200 streets of a metro.

The fancy office. And consequently, all related costs. The first thing every company wants to provide is a ‘great working place’ and provide a challenging environment which gives fulfilment. But employees will work from garages. (Remember Bill Gates, Steve Jobs, Kiran Mazumdar and others who created great organisations from humble beginnings. I interviewed the state sales head under a tree outside our ram shackled project office in Airtel. He stayed with the company for more than ten years and did very well.

STARTUP WITH NEW IDEAS

The cash burn in case of a startup is extremely difficult to predict largely because of the uncertainty related to adoption of the product or idea. During my RPG days when Health & Glow was launched, it was seen as a fancy store with items that were normally difficult to source plus a pharmacy. The initial years showed that when it was launched it was well ahead of time leading to a lot more cash burn than originally predicted. Careful rollout prevented significant shareholder’s wealth being eroded.

The same thing will hold for Flipkart and Amazon. Online buying is increasingly popular. Uber, Ola sell the convenience of travelling in a car instead of driving your own etc. Question is, how long do they keep burning cash? Is there a metric(s) that tells them that the burn is worth it? Amazon has estimated that it will turn profitable in 2025 – how can they say so? What are they estimating? What should they be seeing? These are difficult questions to answer but an answer one must find. My experience is to empirically treat each case based on evidence available on ground. There is no standard formula for this except time tested business assessment tools.

Both online shopping as well as Uber/Ola adoption rate is significant. The idea is accepted but the question still is the rate of adoption. These must be good since we have already seen many changes in pricing and driver compensation (leading to a lot of ruined lives). Surge pricing, different models of car, moderate compensation for vehicle owners that push the revenues.

INVESTOR MINDSET

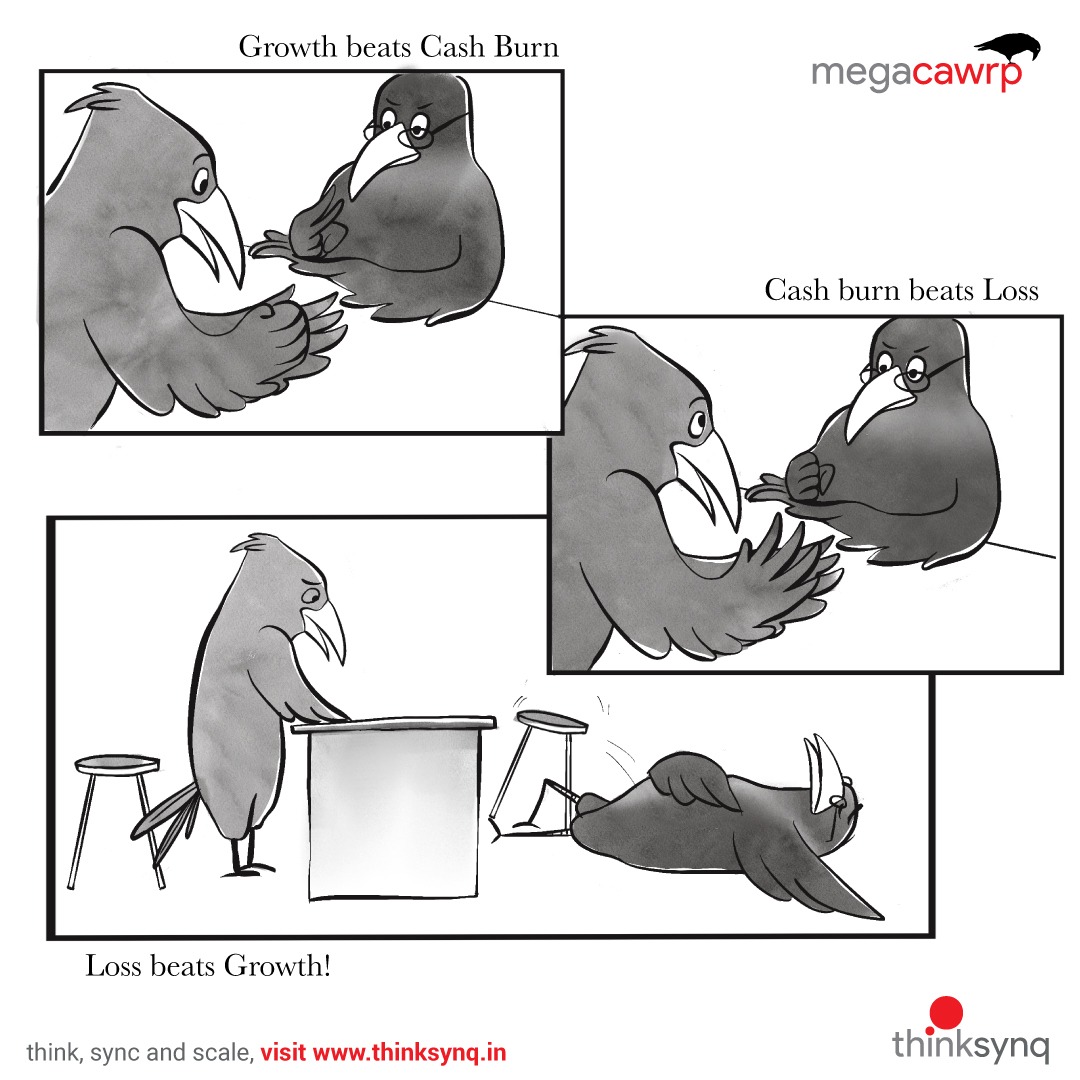

All investors like scale; hence the push for aggressive growth and consequent tolerance to cash burn. But the investors mind is influenced by many factors even when the strategy is to quickly scale and consequently burn cash. Cash burn cannot be endless.

- External factors. Changed circumstances in the investment environment where everyone decides to go aggressive or conservative. Are we in this environment today after a few not so successful IPOs /attempted IPOs in the US?

- The inability of the invested company management to demonstrate the model, ability to scale, prove unit economics etc.

- The ability to accept higher cash burn given success or otherwise of strategy or how other investments in portfolio are performing

- The change of people from the investors’ side. Investors also have investors and bosses – when the going is tough for them they will be at your throat

- Last but not the least best discussed across the table than penning down in an article

PROMOTERS MINDSET

The world has always been moved ahead by game changers. A game changing promoter dreams a dream which is large, bold and audacious. Its ‘bigness’ however comes with a risk. It takes on a life of its own, becomes larger than the promoter and often not completely reflective of the promoter’s world view. In order for the vision to survive, it will be compelled to dance to the tune of capital markets. First time entrepreneurs often don’t recognise this dynamic – nor do first time investors despite all the good intentions of both. But in the initial enthusiasm due to the ‘bigness’ of the opportunity neither promoter nor the investor keeps a close watch on cash burn. This leads to a lot of waste. This is where one should watch out.

CASH BURN AS AN INVESTMENT

In an internal discussion, when I commented that the cash burn is very high

and unsustainable one of our younger executives said ‘cash burn’ must be seen as investment. For a 65 year old this was innovative but sounded correct. Why should investment only be in physical assets. I agreed and asked for the ROI calculation. There were none. If cash burn is investment are we measuring return on that investment – not always.

WHAT TO DO IN A CASH BURN SITUATION (The old habit of being prescriptive)

- Relevance and acceptability of the product must first get established. If there is no product there is no business; value proposition is key.

- The positive unit economics. How fast can you get to a positive unit economics and reach planned level of unit economics; a startup CEO must be constantly focused on this.

- Establish the above two in a small geographical area before expanding; it will help burn less cash in the long run.

- Every day there will be a new idea. You can’t chase all of them – stay focused on key objectives and deliverables.

- Every day look at the business to see where to cut cash burn

- If pricing strategy is used for higher market share see whether volume is increasing rapidly.

- Don’t believe a strategy will work until there is sustained evidence it is working

- Fixed costs should be as minimum as possible; even at a higher cost keep as much as possible as variable in the early stages; easy to correct.

I am often told that one needs to spend and be aggressive to build a large organisation. Remember the gentleman Sunil Mittal who has created a wonderful 10 billion dollar Airtel. When I first informed him of the launch of service in an area which was under my care, his first question was when do we get to EBIDTA breakeven.

Nobody can accuse Sunil Mittal of not chasing a very big dream. Good businessmen will always stay focused on minimising cash burn. Please remember burning cash is not a virtue but sometimes a business necessity and strategy. More often than not, the money belongs to institutional investors who trust our business model and invest. We need to be extra sensitive and responsible while using their money.

At times the investors encourage you to burn more cash for rapid growth. Such a strategy can lead to problems unless managed well. It is like a hand grenade with the pin taken out. It passes from one investor to the other but finally blows on somebody’s face unless responsibly handled. For the investors, the investment in your company is one of their portfolio. If yours doesn’t work something else will and will get averaged out; for you this is the only business and if it fails it is curtains and you start all over again.

Cash burn may be both necessary and unavoidable but need to be responsibly managed.

Our everyday decisions make or break us on a long term”. To understand more what this means for the financial health of a company, To manage your cash flow better get in touch with us https://thinksynq.in/