what is accounts payable management service

accounts payable management service refers to a service offered to businesses to help them manage their outstanding bills and payments to vendors, suppliers, employees, and other creditors. It involves organizing and tracking invoices, ensuring timely payments, and maintaining accurate financial records. accounts payable management services have evolved significantly over the years with advancements in technology and changes in business processes. In the past, it was a manual, paper-based process, which was time-consuming and prone to errors. As businesses grew and started to process a large number of invoices, the need for automation and more efficient systems arose. This led to the development of accounts payable management tools, which enabled businesses to streamline their accounts payable processes and reduce the risk of errors. Today, accounts payable service providers leverage advanced technologies such as AI, machine learning, and robotic process automation (RPA) to automate and optimize the accounts payable process. These services can integrate with other financial systems, offer real-time tracking and analytics, and provide various payment options. They also offer enhanced security features to protect sensitive financial data and reduce the risk of fraud. Accounting outsourcing services have made the entire process faster, more accurate, and more cost-effective for businesses.

our outsourced accounting services

thinksynq offers a host of accounts payable outsourcing services to help businesses improve efficiency, reduce costs, and gain access to expertise and advanced financial systems. Thinksynq ensures that enterprises have accurate and timely payment management & liability accounting with an advanced accounts payable management service supported by a comprehensive procurement and vendor management IT platform.

Some of the services are:

● advisory services: including vendor management, business risk assessment, and process gap analysis.

● invoice processing and management services: sorting, reviewing, and processing invoices while verifying accuracy and compliance with business policies.

● vendor and supplier management services: managing vendor accounts using the in-house comprehensive cloud-based IT tool - procure to pay and periodic account reconciliation process with all stakeholders.

● payment processing and disbursement services: ensuring the prompt and precise distribution of payments to suppliers, vendors, and other creditors as per Service level agreements.

● comprehensive analysis & reporting services: providing regular insights and recommendations to enable crucial business decision-making.

● fiscal governance & tax compliance services: adequate control mechanisms for effective fiscal management & ensuring compliance with tax regulations and preparing accurate tax filings.

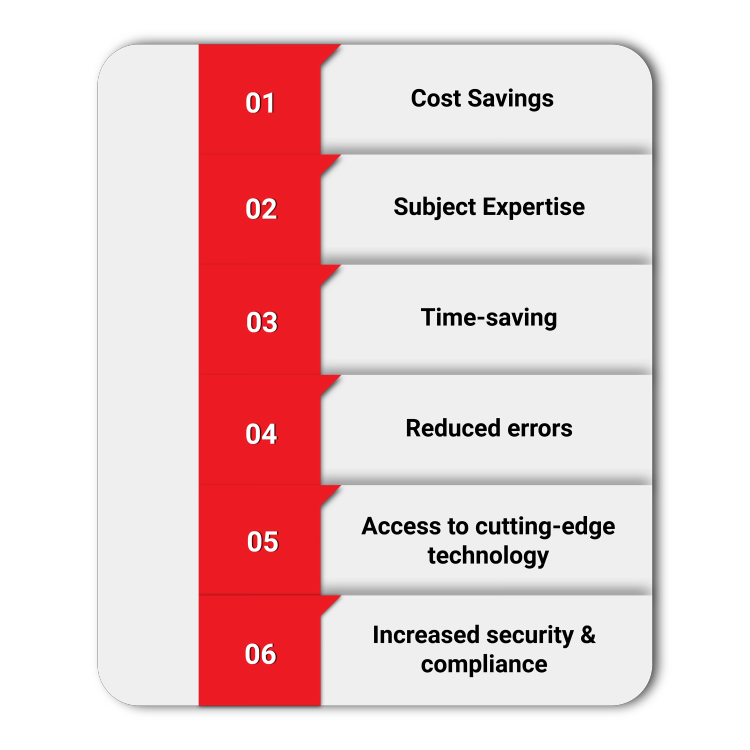

why choose accounts payable services?

● cost savings: outsourcing accounts payable services can be more cost-effective than hiring an in-house team considering the infrastructure, staffing & recurring training costs.

● subject expertise: outsourcing accounting services to a reliable provider can ensure that experienced professionals with in-depth field knowledge handle the job.

● time-saving: outsourcing accounts payable services can free up valuable time and resources for SMEs to focus on their core competencies and growth strategies.

● reduced errors: outsourcing to a reliable accounts payable service provider can reduce the likelihood of errors and improve accuracy in payments and bookkeeping.

● access to cutting-edge technology: opting for accounts payable management service enables access to advanced technology, tools, and software.

● increased security & compliance: an accounts payable services company can help SMEs to stay compliant with local and international regulations, reducing the risk of penalties and fines.

how does an accounts outsourced accounting service work?

outsourced accounting services involving accounts payable is a process that facilitates accurate, efficient, and timely processing of accounts payable transactions. The AP process starts with receiving an invoice from the vendor or supplier, followed by Invoice verification, wherein the invoice is verified for accuracy and validity against purchase orders and release orders, goods, and service receipts, including checking for any discrepancies or errors. Properly coding and scanning invoices into the accounting software, entering and approving purchase orders, entering payment information into the accounting software, producing payment checks, and remitting payments to vendors are the steps that follow. Regular reports are generated to give the business management team an overview of accounts payable performance, including payment accuracy, processing time, and vendor performance. Additionally, accounts payable service management requires managing vendor relationships and reconciling accounts and accounting records.

Hence when a business opts to outsource accounts payable services to an experienced & reliable partner like thinksynq, accurate financial records and timely payments are ensured, which can contribute to the economic health and stability of a company. In addition, access is gained to advanced cloud-computing technology, allowing the business to make data more secure and available across multiple systems. Outsourcing can provide greater transparency to the entire payment workflow process, as companies can track invoices, bills, and payments from one centralized platform.

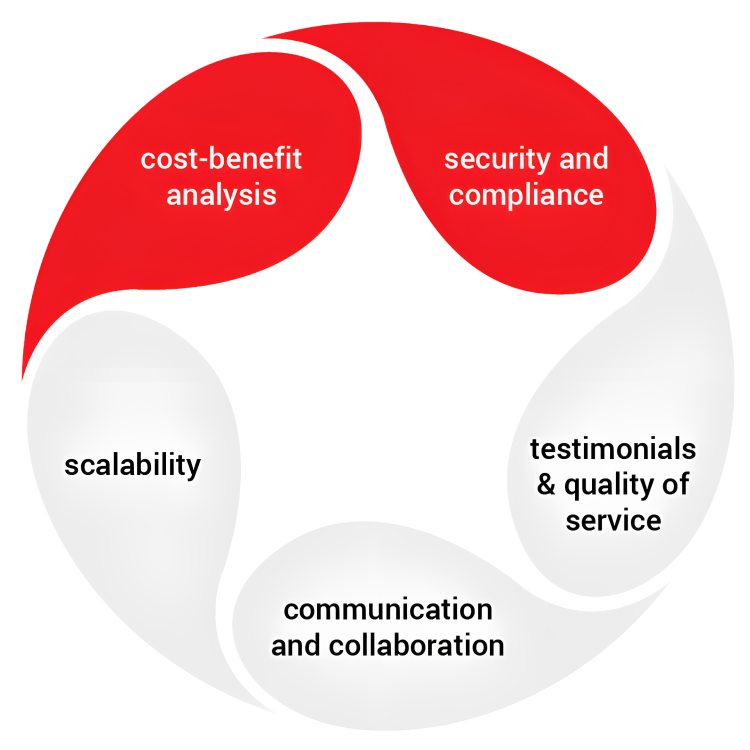

things to consider before outsourcing accounts payable service

we have seen in great detail how outsourcing accounts payable services makes sound business sense as it provides several incremental benefits & additionally, businesses can free up internal resources to focus on more strategic activities that contribute to their competitive advantage and growth. There are umpteen accounting service providers in the market & it is of paramount importance that the below factors are given weightage before signing up with one.

● cost-benefit analysis: when a business considers outsourcing an accounting function, it is essential to conduct comprehensive cost-benefit research to compare the expenses and benefits of outsourcing versus managing the process in-house.

● security and compliance: ensuring the outsourcing partner has robust data security and confidentiality protocols to protect sensitive financial data. The outsourcing partner must be able to comply with all applicable laws, regulations, and industry standards.

● testimonials & quality of service: evaluating the outsourcing partner's experience, expertise, and track record to determine the quality of their services.

● communication and collaboration: ensuring the existence of clearly defined communication and collaboration channels with the outsourcing partner to avoid misunderstandings and ensure timely resolution of issues.

● scalability: assessing the capacity of the outsourcing partner to manage the company's future expansion, alterations in business needs, and variations in transaction volumes.

FAQ’s

» how much do outsourced accounting services cost?

outsourced accounting payable services vary in cost depending on the volume of transactions, the level of expertise required, and the location and size of the outsourcing provider. The other determinants influencing the price are the project's size, scope & complexity, along with the number of staff working on the project. However, overall, outsourced accounting payable services are often much less expensive than the cost of having an employee or team managing a business's accounts payable operations. Additionally, companies can benefit from the savings of outsourcing their accounting services. They can spend less time and less money on accounting costs while ensuring accounts' accuracy and efficient processing.